Segregated Fund VS Mutual Fund

Segregated funds are similar to mutual funds in a few ways. You invest in a fund, both contain a …

Farah Financials / Home » Services » Investment » Segregated Fund VS Mutual Fund

Segregated funds are similar to mutual funds in a few ways. You invest in a fund, both contain a diversified group of investments, it’s easy to access your money, and they both offer professional money management.

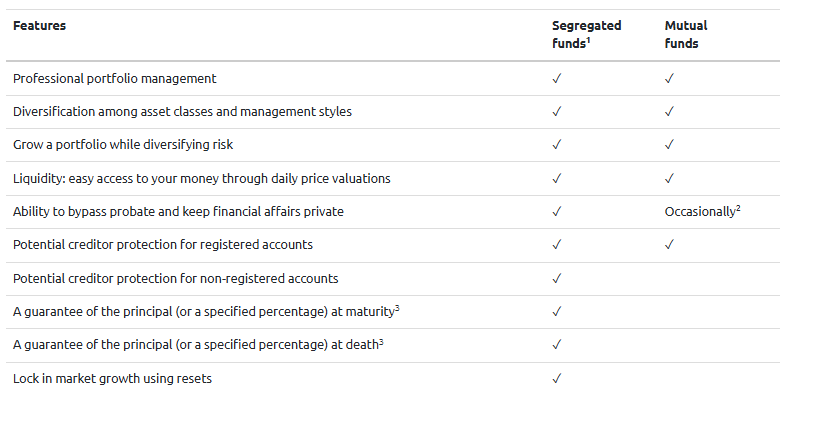

There are, however, some unique advantages to segregated funds that mutual funds don’t offer:

- Maturity guarantees. A segregated fund policy guarantees that the value of your investments at maturity will not be less than a specified percentage of the amount you invest.3

- Death benefit guarantees. Your beneficiary will receive the guaranteed amount or market value of your investments—whichever is higher.3

- The ability to bypass probate. Your beneficiaries get their payout faster, the privacy of your affairs is maintained and the cost of probate fees is avoided

- Potential creditor protection for non-registered accounts. Your segregated fund assets may be protected from creditors in the event of a bankruptcy.**

- Resets. The ability to lock in market gains on your investment.

At-a-Glance: Segregated Funds VS Mutual Funds

1) Segregated fund fees are higher than mutual funds, as they include a management fee and an insurance fee component.

2) Non-registered accounts with joint ownership and right of survivorship only (all provinces except Quebec). Registered accounts can bypass probate when a beneficiary is named.

3) Withdrawals reduce guarantees proportionately. Guarantees end at age 100.

*Probate fees and requirements vary by province.

**You should consult your legal and financial advisor about your individual circumstances.